The Closer – Tariff Turmoil, ISM Expands, Home Improvement – 2/3/25

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin with a look at the S&P 500’s impressive intraday reversal and country ETF performance (page 1). We then look at the latest construction spending data (page 2) and the snapped streak of contractionary readings for the ISM manufacturing index (page 3). We finish with a weekly rundown of positioning data (pages 4 – 7).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Daily Sector Snapshot — 2/3/25

Chart of the Day: DOGE Dogs

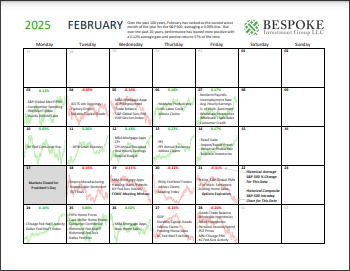

Bespoke Market Calendar — February 2025

Please click the image below to view our February 2025 market calendar. This calendar includes the S&P 500’s historical average percentage change and average intraday chart pattern for each trading day during the upcoming month. It also includes market holidays and options expiration dates plus the dates of key economic indicator releases. Click here to view Bespoke’s premium membership options.

Bespoke’s Morning Lineup — 2/3/25

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“As has been often noted but seldom heeded, selling during a selling panic is rarely an effective strategy.” – Bill Miller

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Last Monday it was DeepSeek, this Monday it’s tariffs that have US equity futures trading down 1-2% ahead of the open. With President Trump ordering tariffs on imports from China, Mexico, and Canada over the weekend, below are price charts of ETFs covering these three countries plus the US (SPY). We include where each ETF is currently trading in the pre-market so you can see how big this morning’s declines are relative to the last six months of action. Yes, all four are set to open quite a bit lower, but all four will also still be above their lows seen over the last month or so. Mexico (EWW) is the only ETF of the group that will be near six-month lows if it opens at current levels.

Brunch Reads – 2/2/25

Welcome to Bespoke Brunch Reads — a linkfest of some of our favorite articles over the past week. The links are mostly market-related, but there are some other interesting subjects covered as well. We hope you enjoy the food for thought as a supplement to the research we provide you during the week.

Shadow or No Shadow?: On February 2nd, 1887, the town of Punxsutawney, Pennsylvania, held the first official Groundhog Day celebration, an event that would grow into one of America’s quirkiest and most enduring traditions. This was the first time a groundhog named Punxsutawney Phil was formally recognized as the nation’s premier meteorological marmot.

The roots of Groundhog Day trace back to European traditions, particularly Candlemas, a Christian festival marking the midpoint between winter and spring. If the weather was clear on Candlemas, more winter was ahead; if cloudy, an early spring was on the way. German immigrants in Pennsylvania brought their own spin to the superstition, swapping out European hedgehogs for the more abundant groundhog.

Over the decades, the spectacle has grown, incorporating top hats, formal proclamations, and a touch of theatricality. Whether or not Phil’s predictions hold up scientifically (spoiler: his accuracy is questionable), Groundhog Day remains a beloved tradition in the US.

AI & Technology

OpenAI says it has evidence China’s DeepSeek used its model to train competitor (Financial Times)

OpenAI suspects Chinese AI startup DeepSeek of using its proprietary models to train a rival AI through a technique called distillation, which extracts knowledge from a larger model to boost a smaller one. DeepSeek’s shockingly low-cost approach has already produced models that rival top US AI, sparking fears that unauthorized training on OpenAI outputs gave it an unfair advantage. OpenAI itself faces legal challenges over alleged copyright violations, so it’s a messy battle over AI training data and intellectual property. [Link]

Continue reading our weekly Brunch Reads linkfest by logging in if you’re already a member or signing up for a trial to one of our two membership levels shown below! You can cancel at any time.

Bespoke Report – 1/31/25 – Disruption

To read our weekly Bespoke Report newsletter and access everything else Bespoke’s research platform offers, start a two-week trial to Bespoke Premium. In this week’s report, we cover DeepSeek, the Fed, earnings, the economy, and some of the market’s wild moves.

Q4 2024 Earnings Conference Call Recaps: Visa (V)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Visa’s (V) Q1 2025 earnings call.

Visa (V) is a global payments technology company that facilitates digital transactions across more than 200 countries and territories. It does not issue cards or extend credit but operates a vast electronic payment network, VisaNet, that connects consumers, businesses, financial institutions, and governments. Visa is a major player in digital payments, leading innovations in contactless transactions, tokenization, and real-time payments. The company reported a strong Q1, with net revenue up 10% to $9.5 billion driven by robust consumer spending and accelerating cross-border transactions. Payments volume grew 9% globally, with the US up 7% and international up 11%, while cross-border volume (ex-Europe) jumped 16%, fueled by e-commerce and travel. Contactless adoption continued expanding, with tap-to-pay usage reaching 57% in the US and 78% in Argentina. Visa Direct hit 10 billion transactions in the past 12 months, reinforcing its role in instant payments. V shares rose 1.9% at the open on 1/31 but gave up most of the gains by the close…

Continue reading our Conference Call Recap for V by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q4 2024 Earnings Conference Call Recaps: PPG Industries (PPG)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers PPG Industries’ (PPG) Q4 2024 earnings call.

PPG Industries (PPG) is known for its paints, coatings, and specialty materials, serving industries like aerospace, automotive, construction, and industrial manufacturing. PPG’s quarter highlighted strategic portfolio optimization, including the divestiture of its US and Canada architectural coatings business, positioning the company for higher margins and a more focused growth strategy. Aerospace coatings hit record sales, with a growing $300 million backlog signaling sustained demand. Industrial coatings gained $100 million in new business, partly due to a competitor’s exit from South America. However, weak European demand and auto OEM softness weighed on overall performance. Tariffs on TiO2 and epoxies will push raw material costs up low single digits in 2025, but PPG plans to offset this with pricing actions. Despite a slow start expected in Q1, management projects full-year EPS growth of 7%, with stronger performance in the second half. After missing on estimates, PPG shares sank more than 5% on 1/31…

Continue reading our Conference Call Recap for PPG by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below:

Q4 2024 Earnings Conference Call Recaps: Deckers Outdoor (DECK)

Bespoke’s Conference Call Recaps use AI to summarize lengthy earnings calls. The commentary below is AI-generated and then edited by Bespoke for quality control. As always, none of these summaries should be construed as recommendations to buy or sell any securities, and investors should do their own research and/or consult with a financial professional before making any investment decisions.

Our latest recap available to Bespoke subscribers covers Deckers Outdoor’s (DECK) Q3 2025 earnings call.

Deckers Outdoor (DECK) is best known for its UGG and HOKA brands. UGG has evolved from a winter boot brand into a global lifestyle powerhouse, while HOKA has rapidly gained market share in the high-performance running and outdoor footwear space. The company thrives on a scarcity-driven pricing model that prioritizes full-price sales over aggressive discounting. DECK provides key insights into consumer demand for premium footwear, serving a mix of fashion-conscious consumers, athletes, and outdoor enthusiasts, with an increasing global presence. DECK delivered a record quarter, with revenue up 17% YoY to $1.83 billion and gross margins hitting an all-time high of 60.3%. UGG’s revenue rose 16% to $1.2 billion, fueled by success internationally, strong full-price sell-through, and new sneaker and hybrid collections. HOKA jumped 24% to $531 million, with DTC sales up 27% and strong international momentum, particularly in China. Heading into Q4, DECK expects a slowdown in growth due to inventory constraints but remains confident in long-term demand. The company topped estimates, but the stock fell close to 20% on 1/31 on the slowing growth story…

Continue reading our Conference Call Recap for DECK by becoming a Bespoke Institutional subscriber. You can sign up for Bespoke Institutional now and receive a 14-day trial to read our newest Conference Call Recap. To sign up, choose either the monthly or annual checkout link below: