Feb 13, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“With regard to matters requiring thought: the less people know and understand about them, the more positively they attempt to argue concerning them.” – Galileo

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

What looked like it would be a troublesome day for bulls yesterday took a positive turn as the S&P 500 opened down nearly 1% at the open after CPI came in surprisingly high. The opening ticks were as bad as things got, though, and from there, stocks staged a comeback throughout the trading session even as yields only pulled back modestly from their intraday highs.

The S&P 500 successfully tested its 50-day moving average right at the open, but bulls still have something to prove as a pattern of lower highs has started to set in since the high in late January. Individual investors appear to be increasingly worried about the market’s churning lately as the American Association of Individual Investors (AAII) gauge of bearish sentiment has surged from 34.0% to 47.3% in the last two weeks!

This morning, futures sit right around the unchanged level ahead of the January PPI and after a rollercoaster overnight session where futures sold off into the Asian close and have rallied since then as European stocks rally (again).

Feb 12, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Time would become meaningless if there were too much of it.” – Ray Kurzweil

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Equity futures are mixed heading into the open and the January CPI report but based on Powell’s testimony in front of the US Senate yesterday, this report will probably have no impact on short-term Fed policy which looks to be on hold. A key reason for that view from the Fed is that while inflation has come down considerably from its peak, it’s become stuck at levels too high for the Fed’s liking. Hence, the moderately restrictive policy stance.

The chart of Core CPI encapsulates this pattern. After peaking at a year/year rate of 6.6% in September 2022, Core CPI steadily pulled back over the next 20 months dropping to a rate of 3.2% last July. Since July, though, the core inflation rate has been stuck at that 3.2% level. The year/year rate was forecast to fall to 3.1% in this morning’s report for January which would have been the lowest rate since April 2021. The actual rate came in higher than expected at 3.3% which is still within the stall speed range we’ve been in since last July. Even if the y/y rate did fall to 3.1%, though, the core rate would still be 0.7 ppts above its pre-Covid peak of 2.4% from 2015 through 2020.

Feb 11, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Common sense is the most widely shared commodity in the world, for every man is convinced that he is well supplied with it.” – René Descartes

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Equity futures are moderately lower this morning with technology leading the way to the downside as markets digest the latest round of tariffs from the President last night. Treasury yields and crude oil are higher, and the only economic report of the day – the NFIB Small Business Optimism survey showed a modest deterioration after the historic post-election surge.

As you probably know by now, this is an important week for interest rates. It starts with today’s Senate testimony by Fed Chair Powell. Then, we’ll get CPI and more Powell testimony at the House tomorrow. Thursday will cap things off with PPI, but there will also be plenty of other Fedspeak sprinkled in between. Maybe all this Fed/inflation news will allow the market to shift some of its attention from the White House!

Heading into today’s Powell testimony, Treasury yields are at an important juncture. The 10-year yield saw a sharp decline from its mid-January peak of 4.8% down below 4.4% but increased in the last few days moving back above 4.5% this morning. As shown in the chart, these levels put the 10-year yield back above its 50-day moving average (DMA) but still below the uptrend line that was broken to the downside last week. It’s common to see a test of a former trend line after it has been broken, and how that test turns out in the short term can often signal the intermediate-term direction going forward. An upside break would potentially signal higher rates going forward while a failed test could indicate a longer downtrend in rate from here.

Feb 10, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“To become good at anything you have to know how to apply basic principles. To become great at it, you have to know when to violate those principles.” – Garry Kasparov

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

US equities sold off throughout the trading session on Friday on concerns that there would be another round of tariff headlines over the weekend that would send stocks lower to kick off the week. Well, we did get another round of tariff headlines (25% tariff on all steel imports to the US and the potential for reciprocal tariffs later in the week). Still, equity futures have taken the news in stride so far, and the major averages are all indicated to open with gains of between 0.4% and 0.7%. As the Super Bowl showed us last night, while the Chiefs were favored and everyone was expecting a close game, outcomes don’t always match expectations.

For just about everyone on the planet, it’s been nearly impossible to stay on top of everything going on in Washington over the last few weeks. And for those who have been trying to keep up, it’s been exhausting. In the Old Testament, even God rested on the seventh day! Since the Inauguration, though, whether you love or hate him, we can all agree that President Trump’s second term has started with a nonstop fire hose of news and headlines.

Amid the backdrop of a nonstop news flow, the market has been surprisingly calm. Over the last 100 trading days, the S&P 500 ETF (SPY) has traded in a relatively narrow range of less than 10%, and Friday’s close was essentially right where the market was just days after the election.

10% may sound like a wide range, but it ranks in just the 13th percentile of all 100-trading day periods dating back to SPY’s inception in 1993. Back in Covid, this reading spiked above 50% and during the Financial Crisis, it widened even more, peaking above 75%!

In the post-Covid era, the current narrow range is even more extreme. As shown in the chart below, there have only been two other times when the 100-trading day range dipped below 10%, and the current level of 9.4% is the lowest of any of them. Let this be a word of advice, the market may seem volatile now, but you can guarantee that things will get more volatile in the weeks ahead.

Feb 7, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“If your work is so smart that only smart people get it, it’s not that smart.” – Chris Rock

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Whether it’s earnings season or the non-stop whirlwind of activity coming out of Washington, it doesn’t seem like there has been nearly as much attention being placed on this month’s employment report as other recent reports. Last month’s report was a major thud on the market as the S&P 500 declined 1.5%, but did mark a short-term low as the change in non-farm payrolls came in 91K stronger than expected.

The stronger-than-expected labor market last month raised fears among investors that the economy was too strong and would cause the Fed to ratchet back the pace of rate cuts in 2025. The ironic part about this scenario is that just four and five months earlier, weaker-than-expected employment reports in August and September spooked the market on concerns that the economy was sliding into a recession. On 8/2, the S&P 500 fell 1.8% when non-farm payrolls came in 61K below forecasts, and on 9/6, the S&P 500 fell 1.7% when payrolls were 21K weaker than expected.

Like many Americans towards the end of the year, the Health Care sector came down with a case of something around the holidays. We didn’t know if it was a cold, Covid, the flu, RSV, or whatever else was floating around, but not many of us were feeling 100%. For the Health Care sector, things were going around too – sentiment towards the insurance companies, the incoming Trump Administration, RFK being nominated as the HHS secretary, being a defensive sector during a market rally, etc. – and the result was a sharp Q4 decline. From its September high to its December low, the sector was down over 13% during a period in which the S&P 500 was up!

Since that low in December, the sector has been on the mend rallying more than 8%, and its YTD gain of just under 7% ranks as the third best-performing sector of the year behind Communication Services and Financials. A look at the chart of the Health Care sector shows that after moving above resistance levels in the last couple of weeks, the sector has been consolidating just above its 50-DMA and levels that had acted as resistance in the first half of 2024 and most recently late last year.

Feb 6, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Status quo, you know, is Latin for ‘the mess we’re in’.” – Ronald Reagan

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Given the sheer volume of earnings reports at this point in the reporting period, it’s hard to keep track of everything hitting the tape. But going through the various headlines since yesterday’s close, we’ve noticed a pickup in the number of companies lowering guidance. Since yesterday’s close, we’ve seen 22 companies lower forecasts going forward compared to just six raising guidance. It’s only one day, but we’ll watch to see if this starts becoming more of a trend. Despite the generally weaker tone from individual companies, equity futures are modestly higher on the day, although they are well off their overnight highs.

Along with equity prices, gold has also been strong. Prices are up again this morning, and if these gains hold throughout the trading day it would be the sixth straight day of record closing highs for the SPDR Gold Trust ETF (GLD) which would be tied for the longest streak of record closing highs since 2011. If you think the stock market has done well over the last year, GLD has rallied over 40%! In the shorter term, after breaking out of its three-month range in late January, GLD has traded higher every day since then.

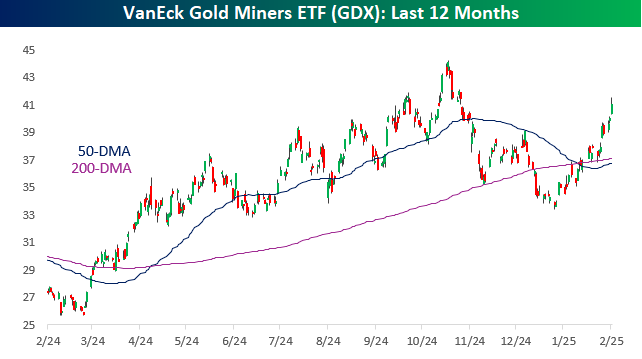

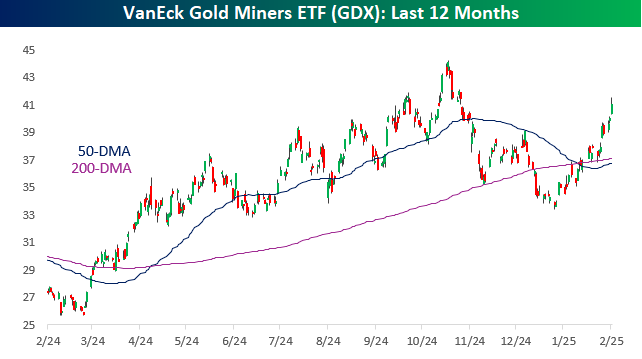

Given the strength in the commodity, it’s no surprise that gold mining stocks have been strong, but maybe not quite as strong as you would expect. Over the last year, the VanEck Gold Miners ETF (GDX) has rallied 50%, but unlike GLD, it is still well below its 52-week high from late October, when the commodity peaked before the most recent consolidation phase. So, in some ways it has some catching up to do!

From a long-term perspective, gold mining stocks have underperformed the commodity. The chart below shows the relative strength of GDX vs GLD over the last ten years. From 2016 through 2022, gold miners were pretty consistent outperformers of the commodity, but since the middle of 2022, there’s been a shift where the commodity has started to outperform.