Mar 4, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The only thing we have to fear is fear itself.” – Franklin D. Roosevelt

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Target CEO Brian Cornell appeared on CNBC earlier, and while we didn’t count, throughout an interview lasting just a few minutes, it seemed like the term “certainty” was mentioned dozens of times, as in there is none. The current market sell-off that’s still less than two weeks old has been driven to this point almost entirely by fears and uncertainty as opposed to actual events. Fears and uncertainty over the economy, fears and uncertainty over interest rate policy, fears and uncertainty over US trade policy, fears and uncertainty over tax policy, fears and uncertainty regarding geopolitical stability. We get it. There’s always uncertainty, but this has been a different level. Like a box of chocolates, you never know what you’re going to get, except that lately they’re all flavors nobody likes (think Orange Cream, Maple Nut Butter, Cherry Cordial, etc).

This morning, you could say we’re getting some certainty as tariffs with China, Canada, and Mexico take effect. These moves are all expected to have an inflationary impact (Cornell noted that produce prices will start rising this week), but that’s not being reflected in crude oil prices and Treasury yields. Equity futures were looking eerily quiet earlier this morning. However, as we approach the opening bell, the tone has steadily weakened as international markets have also moved sharply lower. There’s not much to speak of in terms of economic data today, so unless there are any impromptu comments from the President during the day, the next potential catalyst will be tonight’s address to Congress tonight.

Heading into last week’s earnings report from Nvidia (NVDA), most investors assumed the company would report better than expected results. Based on the company’s past reporting patterns and the comments from the major hyper-scalers when they reported earlier in earnings season, it was also almost a foregone conclusion that the company would raise guidance, especially because they only provide short-term guidance a quarter out. Whatever impact, if any, DeepSeek would ultimately have, it wasn’t going to change short-term spending plans for the coming three months. Given that, in last Wednesday’s email of the Morning Lineup, we mentioned that “How the market reacts to that report could give us a good idea of the market tone as we head into Spring.”

NVDA’s performance since then hasn’t been a good omen, as the stock is down over 13% since its report. As shown in the chart below, NVDA’s price chart, which was already trending lower, now looks like it’s breaking down, and yesterday, the stock closed at its lowest level in close to six months (9/18/24).

The chart below shows every day since the launch of ChatGPT at the end of November 2022 and how many days had passed since NVDA last closed lower than that day’s close. Since the launch of ChatGPT, NVDA has never closed at a 52-week or even a six-month low, and yesterday was the first time it closed even at a 166-day closing low.

Since it comprises about 7% of the Nasdaq, NVDA’s plunge yesterday also took the Nasdaq marginally below its 200-DMA, which is a place it hasn’t been in more than a year – 333 trading days to be exact. The breakdown below its 200-DMA was only the 11th time the index ran more than a year without closing below that level. This just-ended streak ranked as the 7th longest streak of closes above the 200-DMA of all time.

Mar 3, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“We so often look so long and so regretfully upon the closed door, that we do not see the ones which open for us.” – Alexander Graham Bell

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Well, at least it’s March. Anyone with a net long position in the stock market was happy to see February end. Although the S&P 500 finished the month down just 1.42%, the Nasdaq was hit with a decline of just under 4%, and nearly all of it came last week as the index declined 3.5%. Remember, it was only seven trading days ago that the S&P 500 closed at a record high!

This morning, equities are looking to build on last Friday’s gains as investors await the release of the February ISM Manufacturing report. In Europe, the STOXX 600 kicked off the week with gains of close to 1%, driven by a 2%+ rally in Germany. Manufacturing PMI readings for the region generally came in better than expected, but the rally in Germany has also been driven by a 10%+ rally in defense contractor Rheinmetall based on expectations that the EU will increase military spending to support Ukraine.

Getting back to last week’s trading, it was mostly positive at the sector level. As shown in the snapshot below, just four out of eleven sectors finished the week in the red. Technology (XLK) was the big loser, falling close to 4%, along with Utilities (XLU), which fell 1.3%. The two other sectors to finish lower were Communication Services (XLC) and Consumer Discretionary (XLY), which each shed around 1%. The losses in these two sectors were driven by mega caps like Tesla (TSLA) and Amazon.com (AMZN) in the Consumer Discretionary sector and Alphabet (GOOGL) and Meta Platforms (META) in the Communication Services sector. Besides these four sectors, most others were up at least 1%, including Financials (XLF) and Real Estate (XLRE), which gained over 2% each.

Relative to their short-term trading ranges, nine out of eleven sectors remain above their 50-day moving averages (DMA), but then there’s Consumer Discretionary and Technology, which both remain at oversold levels.

Feb 28, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Everybody deserves a fresh start every once in a while.” – Bugsy Siegel

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

It’s been a rough few days for the equity market since last Wednesday’s record closing high, but at least futures are trading modestly higher. Maybe the market is getting a fresh start! After these last six trading days, if positive futures still make you optimistic, what market have you been watching? On five of those six days, the S&P 500’s intraday high came in the first ten minutes of the trading day, and there has been a reliable pattern of afternoon selling the entire time. Just look at the chart below of the S&P 500 ETF (SPY); since last Wednesday’s record high, there have been six straight days where SPY finished the day below where it opened. Is it too much to ask for just one day when Lucy doesn’t pull the football away from Charlie Brown?

We just got a bunch of economic data hitting the tape, and it was mixed. Personal Income increased more than expected, but Personal Spending was weaker than expected. More importantly, though, PCE data, which the market was most focused on, came in right in line with expectations. The immediate reaction in equity futures has been positive, but we’ll see how that plays out as the market digests the numbers.

While you may be thinking TGIF, that hasn’t been the case in the early days of the second Trump Administration. The chart below shows the S&P 500’s performance on every trading day since President Trump was inaugurated, with Fridays and Mondays highlighted in red. Of the nine trading sessions that have occurred on Friday or Monday during this time, the S&P 500 has only been up once (2/10, +0.67%), and the median performance has been a decline of 0.50%.

Feb 27, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“I really try to put myself in uncomfortable situations. Complacency is my enemy.” – Trent Reznor

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Well, we made it through Nvidia (NVDA). The hype surrounding last night’s earnings report was as high as we can remember for any stock reporting earnings in the past and reminiscent of Cisco (CSCO), Intel (INTC), or Microsoft (MSFT) reports in the late 1990s, or Apple (AAPL) reports in more recent years. NVDA’s report wasn’t great, but it wasn’t bad either. The company managed to report better-than-expected EPS and sales, while slightly raising sales guidance. That was good enough for investors who had set the bar low in recent weeks. The stock is currently trading just about 2.5% higher in the pre-market, and Nasdaq and S&P 500 futures are riding its coattails trading higher by more than 0.5%.

Bulls will take it, but as the last few days have shown us, we’re in a market environment where what the market is doing right now is hardly indicative, no less a guarantee of where we’ll be an hour from now let alone the end of the day. Add to that a ton of economic data and several Fed speakers on the calendar, and it’s sure to be an eventful day!

What happened to sentiment? Everywhere you look, fear has set into the collective mood. Indices that measure economic uncertainty have shot up to record highs, even taking out their prior extremes from the early days of Covid. The latest measures of consumer sentiment from the University of Michigan and the Conference Board both also showed much larger than expected declines in their latest readings. But nowhere has the negative turn in sentiment been more pronounced than in the equity market.

The CNN Fear & Greed Index gauges stock market behavior by looking at momentum, breath, options activity, strength in the junk bond market, and demand for safe havens. As of this morning, the index was at 21, putting it in the “Extreme Fear” range.

Over the last year, the current level of the CNN Fear & Green Index is among the lowest. The only time it was lower was in early August when markets briefly sold off as the Japanese equity market crashed over 10% in a single day.

Feb 26, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Greatness comes from character, and character is not formed out of smart people, it’s formed out of people who suffered.” – Jensen Huang

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

After four days in a row of losses for the S&P 500 and Nasdaq, including three days in a row of 1%+ losses for the Nasdaq, bulls are getting a chance to catch their breath this morning as futures are higher across the board. The breather comes just in time as markets gear up for Nvidia’s (NVDA) earnings report after the close. How the market reacts to that report could give us a good idea of the market tone as we head into spring. Besides NVDA after the close, New Home Sales is the only economic report on today’s economic calendar, and we’ll also hear from Richmond Fed President Barkin at 8:30 and Atlanta Fed President Bostic at noon.

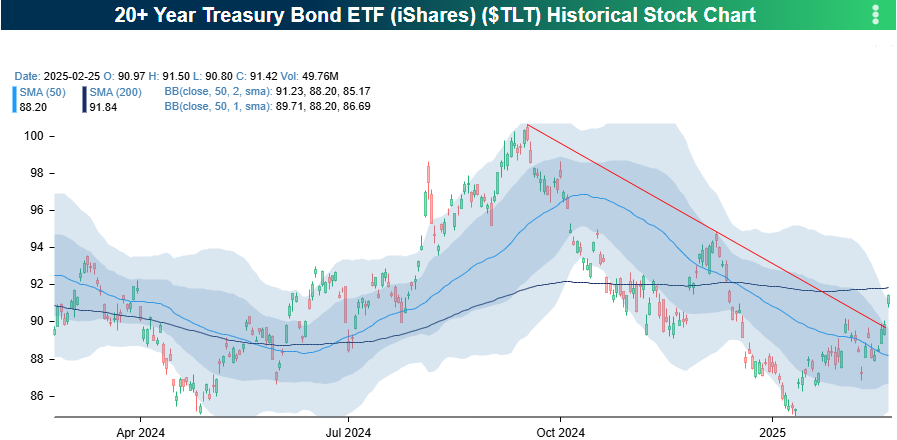

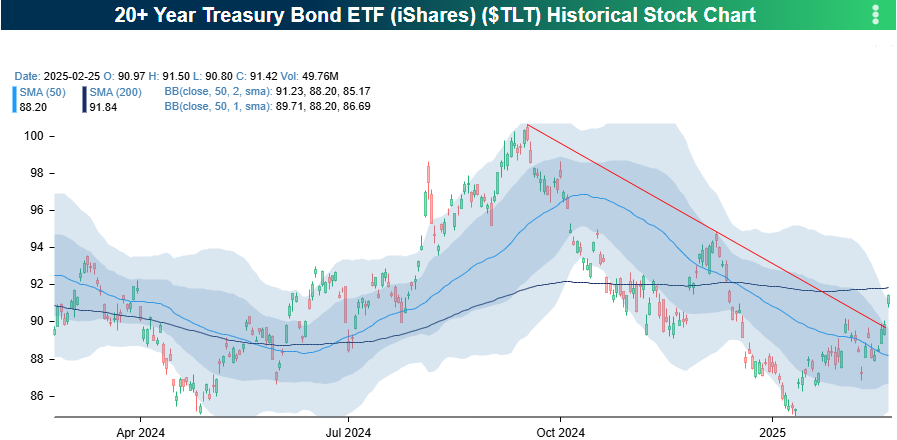

Everything has been turned upside down in the markets over the last week. While equities and bitcoin have pulled back sharply, fixed-income ETFs – especially treasuries – have surged. As shown in the snapshots from our Trend Analyzer, the US Aggregate Bond ETF (AGG) and every Treasury ETF with a maturity longer than a year has moved into extreme overbought territory (more than two standard deviations above their 50-day moving averages (DMA). On the equity side, the S&P 500 hasn’t quite reached oversold territory, but all the other major index ETFs along with Bitcoin have now moved at least into oversold territory. It seems like a while since we last saw a situation where fixed-income securities were moving to the right side of their ranges while equities were moving to the left.

The iShares 20+ year US Treasury ETF (TLT) had a notable move yesterday as it broke its downtrend that has been in place since the peak (trough in long-term yields) right as the Fed started cutting rates in September. It finished yesterday right below its 200-DMA, which could act as resistance going forward, but you have to start somewhere!

Feb 25, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“What you’re thinking is what you’re becoming.” – Muhammad Ali

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Thankfully for US financial markets, they don’t work for the government. Elon Musk told all government employees that they must document five things they’ve accomplished over the last week or resign, so we thought it would be good to see what the markets have accomplished over the last week. Tuesday saw the S&P 500 close at a new all-time high which was followed by another new high on Wednesday. That’s two quick accomplishments. Now, let’s see what else the market has done.

Equities have taken a series of body blows in the three trading days since Wednesday’s high, and like a heavyweight fighter hoping to hang on to the end of the 12th round, the S&P 500 looked likely to make it to the end of the day yesterday and hold above its 50-day moving average (DMA). With less than ten minutes to go in the session, though, sellers unleashed a burst of blows knocking the market down to the mat and finishing the session right near its lows of the day. Holding the 50-DMA for the S&P 500? Not accomplished.

For the Nasdaq 100, a similar song. Unlike the S&P 500, which traded higher for much of the session, the Nasdaq opened positive but almost immediately moved into negative territory and stayed in a standing eight count for much of the session. The late-day decline only pushed it further below its 50-DMA by the time the closing bell rang. Holding the 50-DMA for the Nasdaq 100? Not accomplished.

The 50-DMA has never really been in question for small caps as the Russell 2000 closed below that level in almost every session for the last two months! It’s made attempt after unsuccessful attempt to break above its 50-DMA, but after Friday’s plunge, yesterday it was the 200-DMA that gave way. Back in August and January, the 200-DMA acted as support and the launchpad for a bounce, but this time around, the Russell had no such luck. Holding the 200-DMA for the Russell 2000? Not accomplished.

While not a major index, semiconductors are an import sector for the market, and yesterday the Van Eck Semiconductor ETF (SMH) one-upped the major averages by breaking below both its 50 and 200-DMA. The ETF has been essentially rangebound for the last five months and remains that way even after breaking below both moving averages yesterday. Even if it does set the bar lower heading into the report, this type of weakness heading into Nvidia’s (NVDA) earnings report Wednesday isn’t particularly encouraging, Holding the 50 and 200-DMA for semiconductors? Not accomplished.

Hey Elon, can the market get an extension on that email?