Apr 4, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There is nothing more corrupting, nothing more destructive of the noblest and finest feelings of our nature, than the exercise of unlimited power.” – William Henry Harrison

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

There’s nothing to say this morning except it’s bad out there. Yesterday was an awful day and today isn’t looking much better. In some cases, it’s even worse given the scope of the declines in other areas of the market outside of US equities. Foreign equities are plunging, credit spreads are blowing out, commodities are sharply lower, the VIX is above 45, and the 10-year treasury is comfortably below 4%. The President and his administration wanted lower yields, and they got them. Whether they intended to get here the way we did, we don’t know. We’ve seen a lot over the years, but nothing quite like this.

Yesterday’s nearly 6% decline in the Nasdaq was the largest since March 2020 and the 47th decline of 5%+ in the index’s history. The charts below show the Nasdaq’s daily change over time (top chart) while the second chart shows each occurrence of a 5%+ decline over time. A large share of these declines came during the dotcom bust as there were 20 in the two years from 2000 to 2001 alone while another ten were in 2008.

Apr 3, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“The signing of this act is a momentous occasion in the world’s quest for enduring peace.” – Harry Truman

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

77 years ago today, President Truman made the comments above about his signing the Economic Assistance Act, better known as the Marshall Plan, into law. The Marshall Plan’s primary purpose was to help Western and Southern European countries recover from World War II by rebuilding cities and industries devastated by the war, removing trade barriers between European countries, and creating a more conducive environment between Europe and the US.

By almost all accounts, the Marshall Plan was a big success. But just one day shy of 77 years later, President Trump declared “Liberation Day” and signed an executive order instituting new punishing tariffs on countries around the world. While the tariffs were referred to as reciprocal, the levels were shocking and sent stocks plunging after hours.

Arguments can be made that other countries have been ripping the United States off by charging high levels of tariffs to US exporters. Unlike the Marshall Plan, though, which was meant to aid international economies and foster open trade between countries (even if they placed the US at a disadvantage), last night’s executive order did the opposite. The tariffs enacted by “Liberation Day” will enact a slew of protectionist policies for domestic industries and restrict international trade. If the Marshall Plan was a helping hand to the rest of the world, “Liberation Day” is a big middle finger.

What’s most ironic about last night’s tariff announcements and the rhetoric we’ve heard since Trump came into office is that while the President says he is acting to help US companies, it’s the US stock market that is down the most. The table below shows the performance of the ETFs that track the ten largest global economies. For each one, we show their YTD performance through yesterday’s close and then where they’re trading this morning. Heading into yesterday’s tariff announcement, the US was already the worst performing of the ten largest global economies, and since the announcement last night, the S&P 500 is off 3.4%, as measured by SPY, while none of the other nine ETFs are down as much.

With global markets lower and US futures sharply lower, the S&P 500, as proxied by the SPDR S&P 500 ETF (SPY), is on pace to break below the lows from earlier this week. The next level of potential support is the post-Labor Day September lows and then the lows from last August. That said, markets are rudderless at this point as the level of tariffs outlined last night will only exacerbate consumer and investor concerns about the outlook and create more uncertainty.

Today’s decline will be SPY’s seventh straight downside gap at the open. That ranks as the longest streak since early 2016 and is only one of only seven streaks with as many or more consecutive days of negative selling pressure at the open. The longest streak was ten days in August 2015.

Apr 2, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There is no terror in the bang, only in the anticipation of it.” – Alfred Hitchcock

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

The S&P 500 put in a closing low on March 13th that established the first major low of this correction. So far, we’ve managed to hold above that level, but it’s the one to watch going forward. A close below the 3/13 low will mark a resumption of the downtrend that’s in place. For bulls, the next step in breaking the downtrend would be a close above last Tuesday’s high and then a series of higher highs and higher lows that eventually takes the index to new all-time highs. You can see the process that played out when we had the last major pullback in July/August in the chart below:

Apr 1, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“On April Fools’ Day, believe nothing, trust no one, just like any other day.” – Unknown

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

Below is a review of asset class performance in Q1 using our ETF matrix. For domestic index ETFs, it’s been a nasty run, although we’d note that seven of the eleven US sector ETFs finished the quarter higher.

Outside of the US, however, there was green nearly everywhere in Q1. While the S&P 500 (SPY) was down 4.3%, the all-world ex-US ETF (CWI) gained 5.9% during the quarter, and country ETFs like Brazil (EWZ), China (MCHI), France (EWQ), Germany (EWG), Italy (EWI), Spain (EWP), and the UK (EWU) were all up 10%+.

Commodity ETFs outside of agriculture also posted solid Q1 gains. Both gold (GLD) and silver (SLV) gained more than 15%, while natural gas (UNG) rose 28.6%. Fixed-income ETFs posted solid Q1 returns as well.

Within US equities, the mega-caps accounted for nearly all of the S&P 500’s Q1 drop. As shown below, the five largest stocks in the S&P all fell more than 10% in Q1, and the ten largest are down an average of 11.4% YTD. The rest of the stocks in the S&P 500 are down an average of just 0.6% YTD.

Mar 31, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“At its best, life is completely unpredictable.” – Christopher Walken

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

If Christopher Walken was right, why do the markets feel so terrible? You’ve seen all the different ways of measuring the extreme levels of uncertainty in the markets, and it only seems to get worse with each passing day. After President Trump spent much of last week downplaying the degree of tariffs that would be announced on April 2nd, so-called “Liberation Day”, last night the Wall Street Journal reported that the Administration is now re-considering an across-the-board 20% tariff. So, if you thought you had no idea what was going on, you’re not alone. Adding to that, if you think we’ll suddenly start to see certainty come Wednesday, good luck with that.

Equity futures are sharply lower to start the week even after Friday’s plunge. While the rest of the world appeared to have avoided America’s cold, that’s not the case this morning. Europe’s STOXX 600 is down close to 2% relative to Friday’s close and nearly 6% from its YTD high. Asian stocks were also lower overnight. The Nikkei plunged over 4% and is now down 12% from its high in December.

S&P 500 futures are down just about 1% this morning, and that puts the lows from mid-March into play as the current level of the SPDR S&P 500 ETF (SPY) is right between its intraday low ($549.68) and its closing low ($551.42) from March 13th. If the intraday lows from that day don’t hold, the next potential level of support is the post-Labor Day lows.

Mar 28, 2025

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There’s simply no polite way to tell people they’ve dedicated their lives to an illusion.” – Daniel Dennett

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

As the S&P 500 and Nasdaq look to extend their weekly winning streaks to two, they will need some help. Overnight, Asian markets were lower across the board with the Nikkei down 0.3% while China was down 0.7% as tariff concerns continue to weigh on sentiment. In Europe, things aren’t much better as the fallout from this week’s tariff announcements and others planned for next week on April 2nd, shake investor confidence. The STOXX 600 is down about 0.5% which would put it down by about 1% for the week.

US futures are down across the board with the S&P 500 trading nearly 0.2% lower while the Nasdaq faces a decline of 0.31%. Treasury yields had been rising in recent days even as stocks struggled, but this morning, the 10-year yield is 4 basis points lower to 4.33%. Oil prices are basically unchanged at just under $70 per barrel, while gold and silver are both up about 1%. After hitting a record high two days ago and selling off by over 4% since then, copper prices are marginally lower again this morning.

This morning’s economic calendar is busy with Personal Income and Spending at 8:30, as well as the Michigan Sentiment report at 10 AM. The key report of the day, however, will be the PCE report at 8:30. How this report comes in relative to expectations will likely determine whether the week finishes with a plus sign or minus sign next to it.

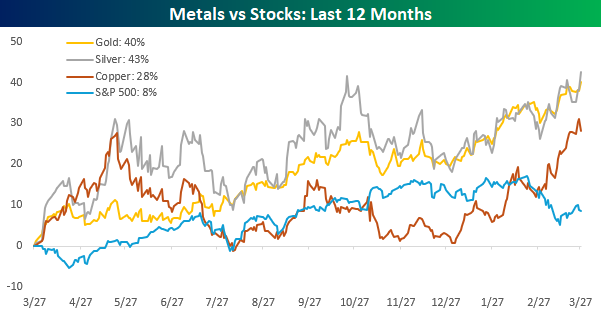

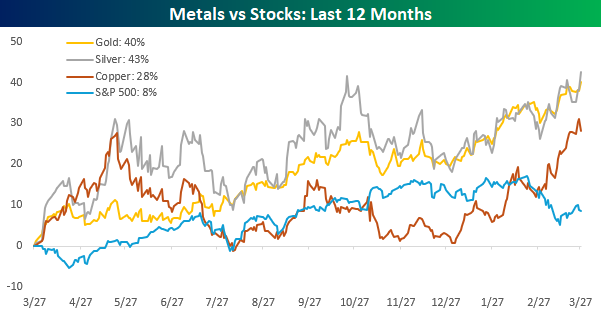

Stocks have had difficulties seeing gains lately, but hard assets like gold, silver, and copper have been ripping higher. Over the last year, gold and silver have rallied 40% or more while copper prices have risen 28%. The S&P 500 is also up on a y/y basis, but it’s up by less than a third of copper’s gain and less than a quarter of gold and silver. While gold and silver have been outperforming the S&P 500, up until just recently copper had been underperforming. Since the S&P 500’s peak in mid-February, though, all three commodities have seen their rallies pick up steam, and this week they all traded at 52-week and/or all-time highs.

This week’s move in copper was particularly interesting. After trading at an all-time high on Wednesday, copper finished the day down more than 2% from its intraday high and fell another 2%+ in Thursday’s session. As you can see in the chart, the commodity had a similar move higher and subsequent reversal early last May when it hit record highs after an even more impressive rally. While it’s tempting to look at the rally in copper as a sign of economic strength, it’s worth pointing out that the price in New York has rallied more than the price in London, and that’s because traders have been stockpiling inventories ahead of anticipated tariffs from the Trump administration.