May 13, 2022

This week’s Bespoke Report newsletter is now available for members.

For both the S&P 500, Nasdaq, and the Russell 2000, 52-week lows were the norm this week, and in the case of the Nasdaq and Russell 2000, the recent plunges took them back to levels not seen since around the November 2020 election. Who would have ever thought that coming out of COVID would prove to be more difficult for markets than COVID itself?

Following up on last week’s Pros and Cons presentation, for this week’s report, we are including a macro update on global markets and the economy that was put together by our macro strategist George Pearkes. Therefore, this week’s Bespoke Report provides just an abbreviated recap of markets this week.

The current backdrop could easily be the most complicated backdrop that investors have ever faced, so our hope is to put things into perspective. The bottom line? Supply chains and inflation remain in flux, but there are signs that these issues could start to work themselves out in the second half. If they do, a less hawkish FOMC could be the market surprise for the second half. A key risk, though? Economic activity remains strong, but there are legitimate signals that demand has peaked.

In addition to this week’s Bespoke Report, we have also included our updated quarterly macro overview (“Capped Inflation & Capped Hike Pace Uncap Returns”). To read this week’s full Bespoke Report and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

May 6, 2022

This week’s Bespoke Report is an updated version of our “Pros and Cons” edition for Q2 2022.

With this report, you’re able to get a complete picture of the bull and bear case for US stocks right now. It’s heavy on graphics and light on text, but we let the charts and tables do the talking!

On page two of the report, you’ll see a full list of the pros and cons that we lay out. We then provide slides for each “pro” or “con” that we’ve highlighted.

To read this report and access everything else Bespoke’s research platform has to offer, start a two-week trial to Bespoke Premium.

Apr 29, 2022

This week’s Bespoke Report newsletter is now available for members.

An appointment for a root canal has sounded better than having to watch this stock market lately. Just when you think things can’t get any worse in this market, they do, as every bounce has been quickly repudiated with stocks grinding down to new lows for the year.

It’s never a good feeling when equities close out the week at their lows, but we’ve now had that happen two weeks in a row. The S&P 500 has now declined at least 1% for four straight weeks while the Nasdaq has been down at least 2.5% for four straight weeks. Since 1971, there have only been four other times where the Nasdaq experienced a similar streak, so this kind of persistent weakness doesn’t occur very often.

When the markets start acting like this, it’s incredibly difficult to make any sense of the day-to-day moves, so for us or anyone to say anything about what to expect in the short-term would be foolish. Long-term investors have experienced worse and the market will eventually turn, but until it does, that root canal doesn’t look all that bad.

The snippet above is pulled from a page from this week’s Bespoke Report newsletter. If you’re not a Bespoke subscriber and you want to read this week’s full Bespoke Report (and access everything else Bespoke’s research platform has to offer), start a two-week trial to one of our three membership levels.

Apr 22, 2022

This week’s Bespoke Report newsletter is now available for members.

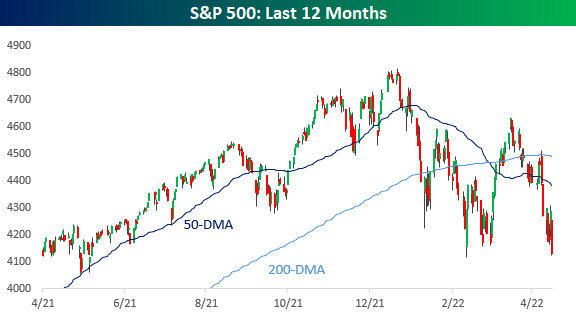

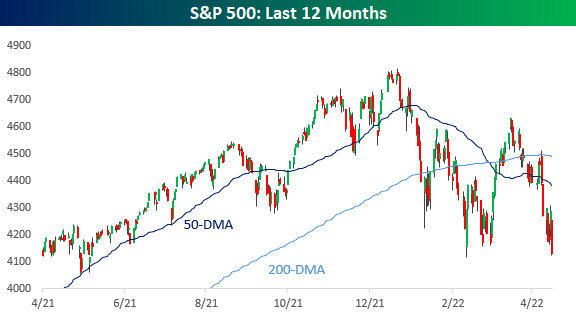

Early Thursday morning, investors were feeling pretty good about the trading week. At that point, the S&P 500 was up 1% on the day and about 2.7% week-to-date, and the index had actually just pushed back above its 200-day moving average.

There was nothing we could identify in the news that caused the S&P to peak around 10 AM ET, but from that point through the closing bell on Friday, the index fell 5.3% in basically as straight of a line lower that you can draw.

Fed Chair Powell did, however, make comments in a speech at the IMF mid-day Thursday where he confirmed that a 50 basis point hike was “on the table” for the May meeting. Markets have been pricing high odds for 50 bps hikes for some time now, but Powell’s comments basically cemented them (for now).

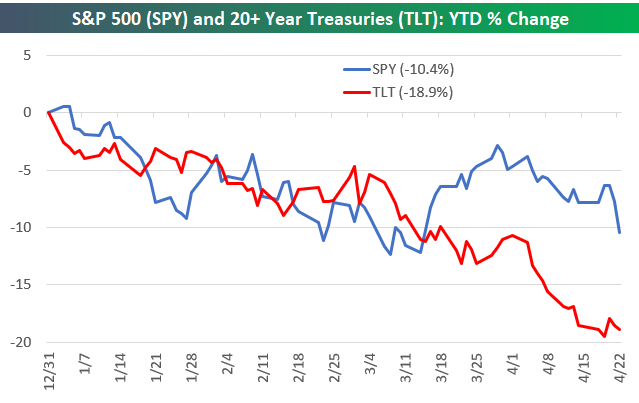

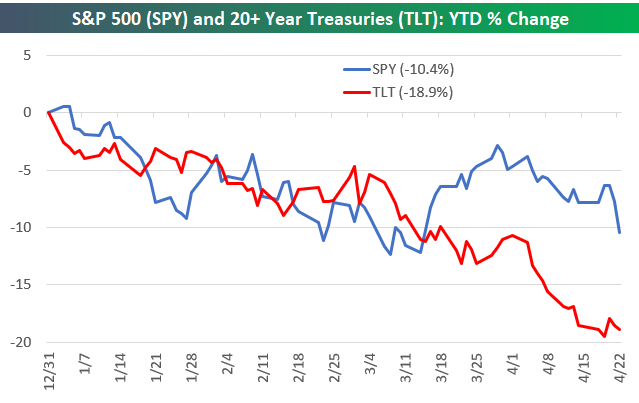

The Powell Fed is known for its jawboning and transparency when it comes to the path for rates. The chart below of equities and fixed income in 2022 tells you what these two asset classes currently think of that jawboning:

The snippet above is pulled from a page from this week’s Bespoke Report newsletter. If you’re not a Bespoke subscriber and you want to read this week’s full Bespoke Report (and access everything else Bespoke’s research platform has to offer), start a two-week trial to one of our three membership levels.

Apr 14, 2022

This week’s Bespoke Report newsletter is now available for members.

We can’t get the Byrds song “Turn! Turn! Turn!” out of our minds lately, but in our heads, we’re singing Churn! Churn! Churn!. Stocks can’t seem to find any direction these days, and that’s being somewhat generous. If anything, the trend has been lower, but with the weekend approaching, let’s be generous in order to keep up the mood. The 200-day moving average is typically considered a major trendline for the S&P 500 with breaks above considered bullish, while moves below suggest a bearish outlook. If that’s the case, what are we to make of the fact that the S&P 500 has crossed above its 200-DMA more than five times this year and crossed below it six times? As we’ve all said to our kids all too often, “Make up your mind already!”

While we had a holiday-shortened week, it was still plenty busy with the kick-off of earnings season and a bunch of economic data. We cover it all in this week’s Bespoke Report along with the big drop in bullish sentiment, some whipsaw moves in the treasury market, a look at seasonality around tax day, and lastly a checkup on the semiconductors.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Apr 8, 2022

This week’s Bespoke Report newsletter is now available for members.

The US equity market is facing big valuation headwinds from rapid shifts in expectations for Federal Reserve policy near-term and a market view that rates will be higher in the long term. With yields surging, the market has relied on ever-higher earnings estimates to stay afloat as we approach Q1 earnings. High earnings estimates make this season a unique risk for the market as the post-COVID bonanza in beats trails off. Foreign central banks are also getting in on the game as interest rates surge into positive territory in the Eurozone. We discuss French elections with the first round of voting this Sunday, as well as touching on policy in Russia and China. Global trade frictions appear to be easing, and used auto prices have started to fall, both of which offer a sunnier picture for inflation. We also look at earnings Triple Plays, credit markets, the strong dollar, the outlook for the Fed’s balance sheet, oil markets, big NASDAQ drops, equity market dividend yields, recession probabilities, and more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.