Jun 24, 2022

This week’s Bespoke Report newsletter is now available for members.

Equity markets turned in a more positive week as interest rates traders mulled the possibility of lower commodity prices bailing out a Fed that looks intent on committing a policy error. We discuss the Fed’s missteps, the widespread declines in a number of major commodity markets, the relationship between recessions and bear markets, the messages being sent by interest rates, why oil supply problems aren’t fixed even if prices have dropped, the implications of large declines like the last few weeks for forward returns, global equity market performance and trends, bad overseas economic data this week, slowing manufacturing surveys in the US and around the world, housing affordability, interest rate sensitive sectors of the stock market, and more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Jun 17, 2022

This content is for members only

Jun 10, 2022

This week’s Bespoke Report newsletter is now available for members.

Every week, we show numerous charts to illustrate key trends in the market and economy in order to try and make sense of whatever is going on in the market. These days, though, only one chart matters—prices at the pump. Heading into this weekend, the national average price of a gallon of gas approached $5, a level it will almost certainly breach over the weekend. Not only are prices at a record high, but the pace of increase has been unprecedented. Since the COVID lows, the national average price has nearly tripled. Since the start of 2021, prices are up 122%, and this year prices are up 52% in less than six months. For just about every issue facing the market these days, gas prices are in some way related to it.

We jus published this week’s report which covers the meteoric rise in gas prices, inflation, and all the other issues weighing on markets.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Jun 3, 2022

This week’s Bespoke Report newsletter is now available for members.

It’s a turbulent and frustrating time in American society and financial markets alike. But amidst the chaos, there are reasons for optimism. Lower valuations mean higher forward returns, all else equal, and underlying earnings continue to rise at a robust pace. Economic activity is slowing, but from a high level, while some of the tightest commodity markets with the most dramatic price action have been pulling back over the last few months amidst very high volatility across commodities. The dollar is also pulling back broadly against almost all foreign currencies, with implications for relative performance of stocks that have international exposure. We also take a deep look at manufacturing and services sector activity indices for May released this week and the results of Friday’s employment situation report. We also discuss background checks for firearms purchases, jobless claims data, trends in interest rates, equity valuations, and more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

May 27, 2022

This week’s Bespoke Report newsletter is now available for members.

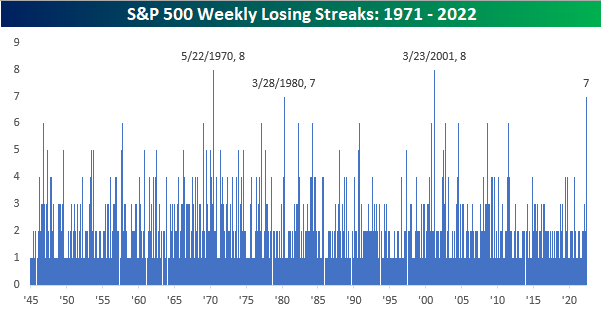

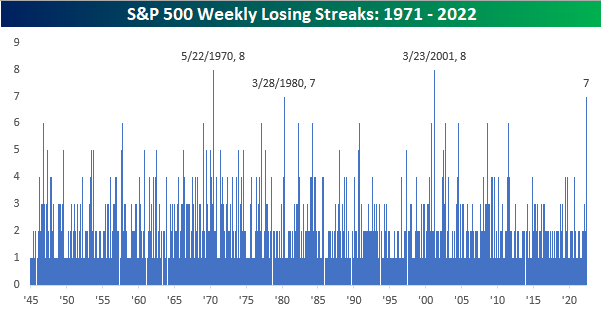

Finally! After seven consecutive losing weeks for the S&P 500, the index managed to close higher this week. And it was quite the move with SPY up more than 6% for its best one-week gain since the first week of November 2020 (Election Week).

Looking for further insights into the move, we noticed that the market also traded higher during regular trading hours (from the open to the close) on all five trading days this week as well, which signifies a sentiment-driven rally with buyers rushing into stocks intraday due to FOMO (fear of missing out). In SPY’s history, there have actually been 50 other weeks since the ETF began trading in 1993 where it gained from the open to the close on all five trading days from Monday through Friday. But this was the first time we’ve seen SPY post intraday gains all five days during the week with at least four of those gains being 1% or more.

For the month now, the S&P 500 is up 0.65%, and the bond market is also up more than 1%, which means that if we can make it one more trading day (Tuesday) without falling apart, all of those “60/40” investors out there will be able to open their May statements without a spike in blood pressure!

The snippet above is pulled from a page from this week’s Bespoke Report newsletter. If you’re not a Bespoke subscriber and you want to read this week’s full Bespoke Report (and access everything else Bespoke’s research platform has to offer), start a two-week trial to one of our three membership levels.

May 20, 2022

This week’s Bespoke Report newsletter is now available for members.

How’s the glass? Half-full? No way. It’s not even half empty. It’s been emptied, put in the recycling machine, and crushed to pieces. We have a Fed chair talking about a ‘painful’ period of policy normalization, and a Treasury Secretary telling the public that a soft-landing is ‘conceivable’ with a little bit of ‘skill and luck.’ Somebody get us a rabbit’s foot and some four-leaf clovers, the fate of the world’s largest economy hinges on it! Need they be reminded of the famous quote: “Hope is not a strategy”?

We’re trying something a little different this week. With no economic data and little in the way of earnings news to speak of today, we’re sending out this week’s Bespoke Report early. Given the volatility in the market lately, we’re sure to miss some big moves throughout the trading day, but they’re unlikely to have a major impact on this year’s trends (famous last words).

Barring a 3.1% rally on Friday, this week will mark the seventh straight week that the S&P 500 finished the week in the red. That would be the longest streak of weekly losses for the index since March 2001 and just the fourth streak of seven or more weekly losses in the post-WWII period. It’s a small sample size, but these types of streaks haven’t occurred during particularly positive periods for the equity market.

The snippet above is pulled from a page from this week’s Bespoke Report newsletter. If you’re not a Bespoke subscriber and you want to read this week’s full Bespoke Report (and access everything else Bespoke’s research platform has to offer), start a two-week trial to one of our three membership levels.