Oct 28, 2022

This week’s Bespoke Report newsletter is now available for members.

We’re on pace for the best October on record for the Dow and the strongest month period for that index since the 1970s. But that masks two facts which should give bulls little comfort: rallies are more violent during bear markets and there is no sign the Federal Reserve is ready to call it quits on its tightening cycle. We take a look at earnings, which are deteriorating versus recent earnings seasons including both lower beat rates and more guidance cuts, and the global backdrop including soaring policy rates that have yet to be felt fully by economies around the world. We also review a very busy US economic data week in detail, covering everything from wage growth to manufacturing activity to savings rates. We cover all that and much more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Oct 20, 2022

This week’s Bespoke Report newsletter is now available for members.

This week was a bit of an in-betweener as the economic calendar was extremely light (there are no reports on the calendar for Friday), and we’re still a couple of weeks from the peak earnings season. With respect to the data we did see, housing data, the index of leading indicators, and movements in various points on the yield curve suggest that a recession is imminent if we aren’t already in one. Earnings results told a different story, though. Maybe it’s just a factor of low expectations, but companies reporting so far have delivered predominantly better-than-expected reports. Even stranger in some respects was the fact that through Thursday, stocks were actually up on the week!

You’ll definitely want to read this week’s Bespoke Report if you’re looking for help understanding what’s going on in markets these days. To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Oct 14, 2022

This week’s Bespoke Report newsletter is now available for members.

In this week’s newsletter, we highlight some absolutely crazy market stats from the last few trading days and then introduce a new “equity market risk gauge” that clients can use to quickly understand our overall market view using eight key components.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Oct 7, 2022

This week’s Bespoke Report newsletter is now available for members.

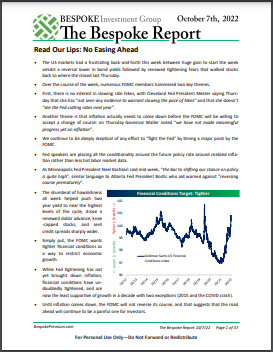

Markets tried and failed once again this week to catch a Fed pivot, but with the central bank refusing to believe inflation has peaked optimism was eventually dashed. Another strong jobs report on Friday sent stocks tumbling in yet another tightening of financial conditions. It’s not just stocks, either. We discuss the move higher in Treasury yields, the rise in the dollar, and rising corporate bond yields from a long-term perspective and in the context of the Fed’s campaign to keep pushing policy tighter. OPEC+ was also in the headlines this week, and we give a full analysis, along with summaries of PMI indices in the United States, a preview of earnings season, analysis of mortgage rates’ surge, discussion of the housing market, recaps of multiple labor market data releases received this week, and much more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Sep 30, 2022

This week’s Bespoke Report newsletter is now available for members.

Remember earlier this year when Fed official after official was happy to be in front of any microphone and proclaim that tighter monetary policy would have little impact on the health of the economy? Well, that policy has evolved over the last nine months. In May, Chair Powell said that policy moves could result in a ‘softish landing’ for the US economy. Softish eventually turned to ‘some pain’ on the horizon, and then this month the Fed Chair told reporters at a press conference that “No one knows if this process will lead to a recession” which in Fed-speak translates to “it’s on.”

Everywhere you looked this week, Fed officials were speaking, and their message was in sync. They are focused on one thing and one thing only—stamping out inflation, and no amount of economic weakness will knock them off course until they are 110% certain that their goal has been met. Each official reiterated the same point, but just in case it wasn’t obvious, Cleveland Fed President Loretta Mester made herself loud and clear on 9/29 when she said that a “recession won’t stop the Fed from raising rates.” Good luck economy!

In this week’s Bespoke Report, we summarize recent market returns, the crazy moves in the fixed income market, economic trends increasingly pointing to a recession, some extremely oversold technical conditions, and much more.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.

Sep 23, 2022

This week’s Bespoke Report newsletter is now available for members.

There’s no sign of a let-up in Fed tightening plans this week, leaving investors to ask the question: how much further does the Fed have to hike before the economy breaks? Yet another FOMC press conference with novel arguments for hawkishness leads to the inescapable conclusion that the FOMC will keep tightening until something breaks. So far nothing has, though catastrophic price action in interest rates, a disastrous week for UK assets on the back of a new fiscal package, and a ripping US dollar are all the sorts of events that would lead to a breakdown in the financial system that might cause the Fed to hold off. We discuss all the implications for markets as well as sector-level analysis of the US and Europe, a look at seasonality, a review of falling inflation in the Great White North, comprehensive analysis of US economic data from this week, and much more in this week’s Bespoke Report.

To read this week’s full Bespoke Report newsletter and access everything else Bespoke’s research platform has to offer, start a two-week trial to one of our three membership levels.