See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“There’s simply no polite way to tell people they’ve dedicated their lives to an illusion.” – Daniel Dennett

Below is a snippet of commentary from today’s Morning Lineup. Start a two-week trial to Bespoke Premium to view the full report.

As the S&P 500 and Nasdaq look to extend their weekly winning streaks to two, they will need some help. Overnight, Asian markets were lower across the board with the Nikkei down 0.3% while China was down 0.7% as tariff concerns continue to weigh on sentiment. In Europe, things aren’t much better as the fallout from this week’s tariff announcements and others planned for next week on April 2nd, shake investor confidence. The STOXX 600 is down about 0.5% which would put it down by about 1% for the week.

US futures are down across the board with the S&P 500 trading nearly 0.2% lower while the Nasdaq faces a decline of 0.31%. Treasury yields had been rising in recent days even as stocks struggled, but this morning, the 10-year yield is 4 basis points lower to 4.33%. Oil prices are basically unchanged at just under $70 per barrel, while gold and silver are both up about 1%. After hitting a record high two days ago and selling off by over 4% since then, copper prices are marginally lower again this morning.

This morning’s economic calendar is busy with Personal Income and Spending at 8:30, as well as the Michigan Sentiment report at 10 AM. The key report of the day, however, will be the PCE report at 8:30. How this report comes in relative to expectations will likely determine whether the week finishes with a plus sign or minus sign next to it.

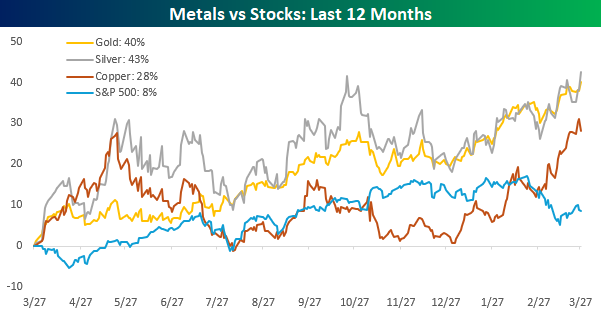

Stocks have had difficulties seeing gains lately, but hard assets like gold, silver, and copper have been ripping higher. Over the last year, gold and silver have rallied 40% or more while copper prices have risen 28%. The S&P 500 is also up on a y/y basis, but it’s up by less than a third of copper’s gain and less than a quarter of gold and silver. While gold and silver have been outperforming the S&P 500, up until just recently copper had been underperforming. Since the S&P 500’s peak in mid-February, though, all three commodities have seen their rallies pick up steam, and this week they all traded at 52-week and/or all-time highs.

This week’s move in copper was particularly interesting. After trading at an all-time high on Wednesday, copper finished the day down more than 2% from its intraday high and fell another 2%+ in Thursday’s session. As you can see in the chart, the commodity had a similar move higher and subsequent reversal early last May when it hit record highs after an even more impressive rally. While it’s tempting to look at the rally in copper as a sign of economic strength, it’s worth pointing out that the price in New York has rallied more than the price in London, and that’s because traders have been stockpiling inventories ahead of anticipated tariffs from the Trump administration.