Dec 29, 2022

Log-in here if you’re a member with access to the Closer.

Looking for deeper insight into markets? In tonight’s Closer sent to Bespoke Institutional clients, we begin tonight with a look at which stocks led in the gains today and check in on fund flows (page 1). We then review the latest changes in population in the United States (pages 2 and 3). We finish with recaps of the latest EIA data (page 4) and the 7 year note auction (page 5).

See today’s full post-market Closer and everything else Bespoke publishes by starting a 14-day trial to Bespoke Institutional today!

Dec 29, 2022

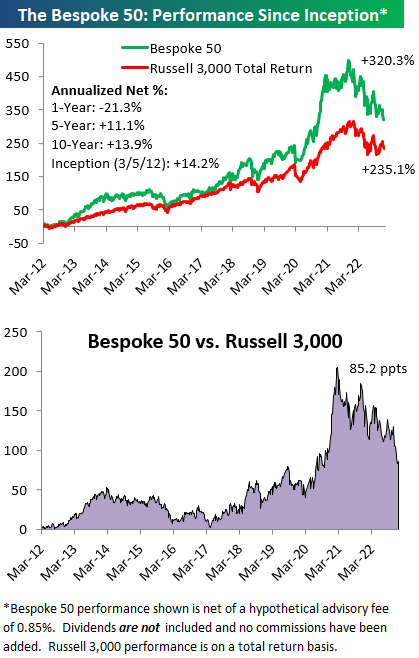

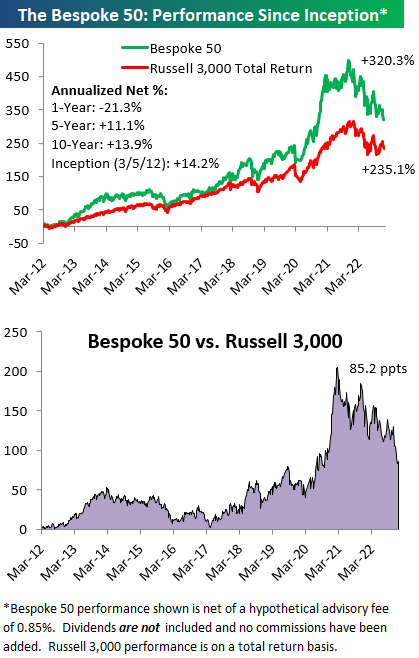

The “Bespoke 50” is a basket of noteworthy growth stocks in the Russell 3,000. To make the list, a stock must have strong earnings growth prospects along with an attractive price chart based on Bespoke’s analysis. The Bespoke 50 is updated weekly on Thursday unless otherwise noted. There were no changes to the list this week.

The Bespoke 50 is available with a Bespoke Premium subscription or a Bespoke Institutional subscription. You can learn more about our subscription offerings at our Membership Options page, or simply start a two-week trial at our sign-up page.

The Bespoke 50 performance chart shown does not represent actual investment results. The Bespoke 50 is updated weekly on Thursday. Performance is based on equally weighting each of the 50 stocks (2% each) and is calculated using each stock’s opening price as of Friday morning each week. Entry prices and exit prices used for stocks that are added or removed from the Bespoke 50 are based on Friday’s opening price. Any potential commissions, brokerage fees, or dividends are not included in the Bespoke 50 performance calculation, but the performance shown is net of a hypothetical annual advisory fee of 0.85%. Performance tracking for the Bespoke 50 and the Russell 3,000 total return index begins on March 5th, 2012 when the Bespoke 50 was first published. Past performance is not a guarantee of future results. The Bespoke 50 is meant to be an idea generator for investors and not a recommendation to buy or sell any specific securities. It is not personalized advice because it in no way takes into account an investor’s individual needs. As always, investors should conduct their own research when buying or selling individual securities. Click here to read our full disclosure on hypothetical performance tracking. Bespoke representatives or wealth management clients may have positions in securities discussed or mentioned in its published content.

Dec 29, 2022

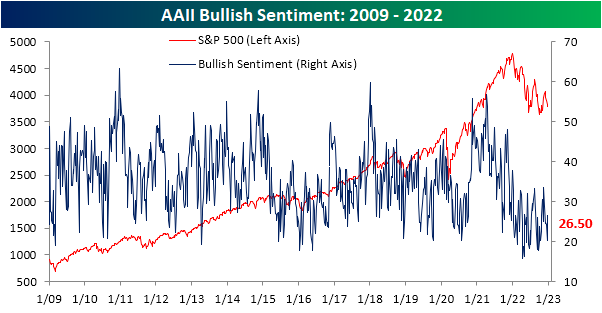

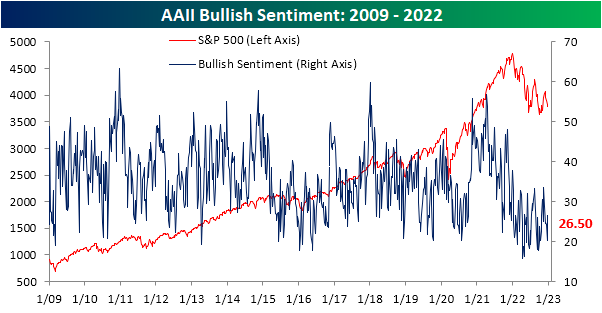

The last week of the year also brings in the last reading on investor sentiment for 2022. Perhaps a bout of new year’s optimism has overridden the negative impact of the market’s continued decline, but bullish sentiment actually rebounded up to 26.5% after spending four straight weeks below 25%. That leaves the reading right in the middle of the past year’s range.

Bearish sentiment, on the other hand, fell from a recent high of 52.3% down to 47.6%. Unlike bullish sentiment, that level remains a bit more elevated. Outside of last week’s 50%+ reading, it would have been the highest reading since October 20th.

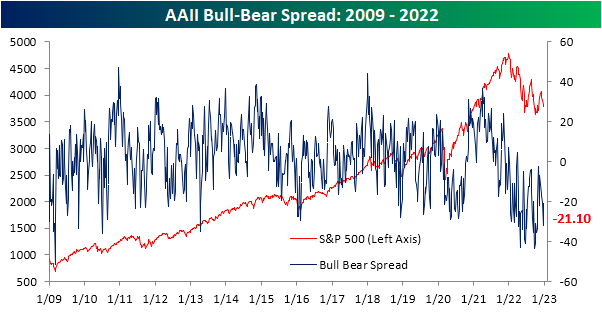

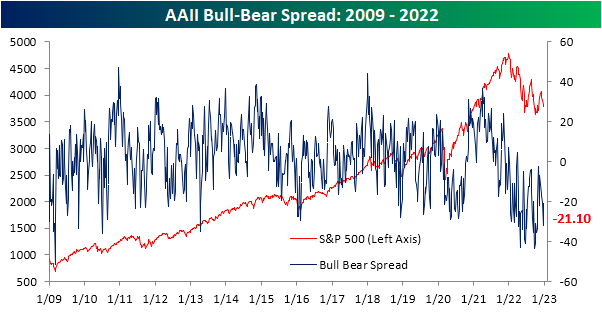

In spite of a slightly more bullish tilt, this week’s data continues to show sentiment is dominated by bears. The bull-bear spread favors bears by 21.1 percentage points; the third week in a row with a sub -20 reading.

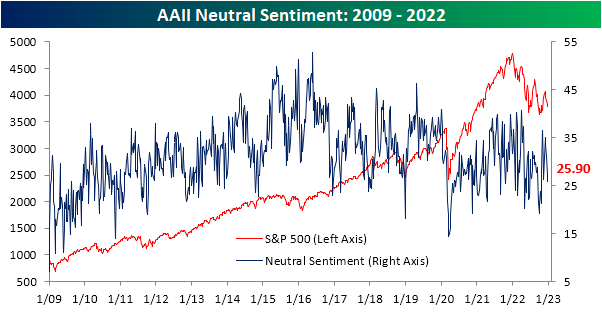

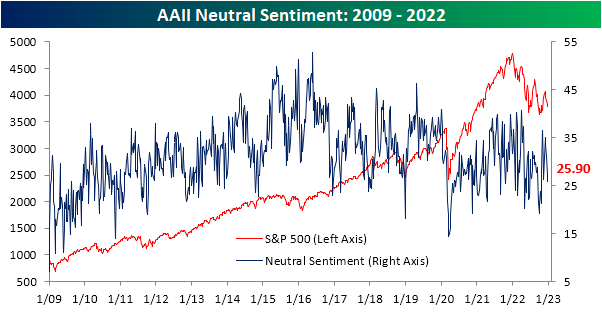

Not all of the gains to the bullish camp came from the bears. The share of respondents reporting neutral sentiment was also lower this week falling for the fourth week in a row. This week’s 1.5 percentage point drop was the smallest of that four-week span but brings the indicator to the lowest level since October 20th. Click here to learn more about Bespoke’s premium stock market research service.

Dec 29, 2022

As we noted in an earlier post, today’s release of the AAII survey gives us the final reading of the year on sentiment, solidifying a number of points as to just how dour the investor outlook has been.

For starters, the bull-bear spread heavily favors bears, and that has been the case for some time now. As shown below, the spread has been negative (meaning a higher share of respondents are reporting as bearish than bullish) for a record 39 weeks in a row- over a month longer than the previous record which occurred recently in 2020.

Across all weeks in 2022, bullish sentiment averaged a reading of merely 24.73%. Since the survey began in 1987, that is a record low. In fact, the previous lowest readings were a few percentage points higher at 27.29% and 27.08% in 1988 and 1990, respectively. Meanwhile, the average reading on bearish sentiment was historically elevated at a record of 46.2%, surpassing the prior record set in 2008 by one percentage point. Prior to 2008/2009, only 1990 saw a very high average reading for bearish sentiment.

As we highlighted in an earlier tweet, given the low readings on bullish sentiment, there was not even a single week this year in which bullish sentiment came in above its historical average of 37.63%. Of course with a low share of survey respondents reporting as bullish, a larger share would be reporting as bearish. To match the impressive reading with no weeks seeing above-average bullish sentiment, nearly every week this year (51) has seen bearish sentiment come in above its historical average of 31%, tying the record high set in 2009.

As previously mentioned, bullish sentiment averaged a reading below 25% this year. Given that reading, it should come as no surprise that 2022 also saw a record number of weeks (30) with bulls below 25%. Prior to this year, 1988 (one year after the survey began) was the prior record at 23 weeks. In other words, this year there were nearly two months more in which less than a quarter of investors reported as bullish than the previous record. Additionally, there had been 17 weeks in which over half of the responses were bearish. Similar to the number of weeks in which bearish sentiment was above average, that ties 2008 for the record high. Click here to learn more about Bespoke’s premium stock market research service.