Dec 30, 2022

This week’s Bespoke Report newsletter is now available for members. (Log in here if you’re already a subscriber.)

View this week’s Bespoke Report newsletter by starting a one-month trial, or click the image below to view our membership options page.

Dec 30, 2022

Bespoke’s Crypto Report contains numerous technical, momentum, and sentiment charts for bitcoin, ethereum, and other key cryptos. Page 1 of the report includes our weekly commentary on the space and attempts to identify any new trends that are emerging. The remaining pages include important overbought/oversold levels to watch, charts on historical drawdowns and rallies, seasonality trends, futures positioning data, Google search trend shifts, and more. Our weekly Crypto Report is produced so that followers of the space can more easily stay on top of price action, technicals, seasonality, and sentiment.

Sign up for a monthly or annual subscription to Bespoke Crypto to receive our weekly Crypto Report and anything else we publish related to cryptos. Note: If you’re currently a Bespoke Premium, Bespoke Newsletter, or Bespoke Institutional subscriber, you’ll need to subscribe to Bespoke Crypto as an add-on to receive access. The weekly Crypto Report and any additional crypto analysis is not included with our Premium, Newsletter, or Institutional memberships. You can sign up for Bespoke Crypto and receive our Crypto Report in your inbox weekly using the monthly or annual checkout links below. If you sign up for the annual plan, the first year of access is 50% off!

Bespoke Crypto Access — Monthly Payment Plan ($49/mth)

Bespoke Crypto Access — Annual Payment Plan ($247.50 for the first 12 months, then $495/year in year 2 and beyond)

Bespoke Investment Group, LLC believes all information contained in this service to be accurate, but we do not guarantee its accuracy. None of the information in this service or any opinions expressed constitutes a solicitation of the purchase or sale of any securities, commodities, or cryptocurrencies. This service contains no buy or sell recommendations. This is not personalized advice. Investors should do their own research and/or work with an investment professional when making portfolio decisions. As always, past performance of any investment is not a guarantee of future results. Bespoke representatives or clients may have positions in securities discussed or mentioned in its published content.

Dec 30, 2022

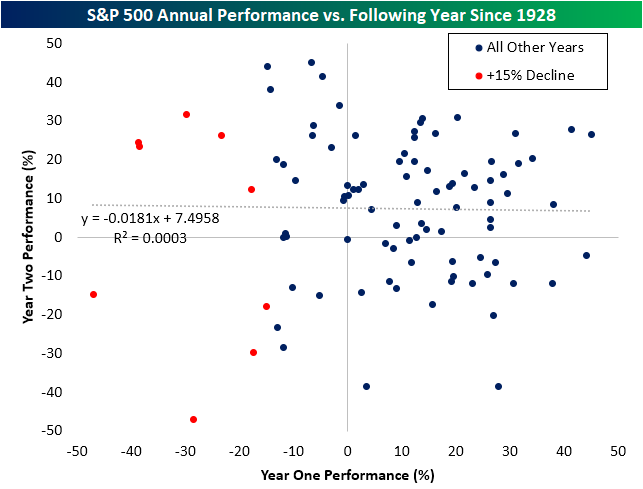

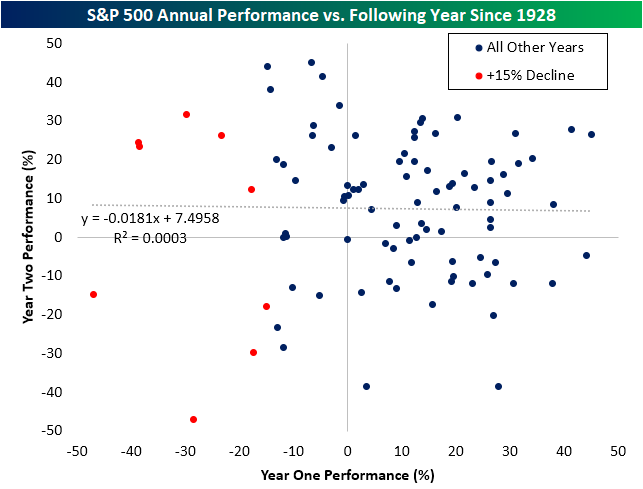

It’s finally the last trading day of what has been a tough year for most asset classes, especially equities. As of this writing, the S&P 500 is on pace to finish the year with a 19.83% loss. Over the course of the index’s history, there have only been nine other years in which the S&P 500 has fallen at least 15% for the full year. Of course, turning the page of the calendar does not mean all the issues dragging stocks lower magically go away, and a big decline one year does not in and of itself mean we’re due for a big gain the next year.

In the chart below we plot the annual percentage change of the S&P 500 versus its move the following year. Taking a linear regression shows that performance one year is not a good explainer for next-year performance with a miniscule R squared of 0.0003. Looking just at those years where the S&P fell 15%+, five times the index posted gains the next year, while four times the index posted further declines. Click here to learn more about Bespoke’s premium stock market research service.

Dec 30, 2022

See what’s driving market performance around the world in today’s Morning Lineup. Bespoke’s Morning Lineup is the best way to start your trading day. Read it now by starting a two-week trial to Bespoke Premium. CLICK HERE to learn more and start your trial.

“Hope smiles from the threshold of the year to come, whispering ‘it will be happier’…” – Alfred Lord Tennyson

Below is a snippet of content from today’s Morning Lineup for Bespoke Premium members. Start a two-week trial to Bespoke Premium now to access the full report.

In case you missed it last Friday, we emailed out our annual Bespoke Report which covers everything you need to know about the setup for financial markets and the economy heading into 2023. You can read it here.

Bespoke Report 2023

At least we hope next year will be happier! That’s not the case this morning, though, as markets are giving the pulls one last dagger to close out the year. Nasdaq futures are currently down over 1% while the S&P 500 is indicated to open down roughly half of one percent. Besides the fact that the calendar still says 2022, there’s little in the way of catalysts driving the weakness. US Treasury yields are modestly higher on the day while crude oil trades lower. The only economic report on the calendar today is the Chicago PMI which is expected to rebound following last month’s surprise plunge. That index could use a lift as it’s currently in the midst of its largest y/y decline since 1980! From a market perspective, can today’s closing bell come soon enough?

For all the volatility we’ve seen this month, it was surprising to see that the nine 1% days in the S&P 500 (up or down) this month only ranks tied for 10th going back to 1952 when the five-day trading week in its current form started on the NYSE. In fact, even last year just as the S&P 500 was about to peak, the month of December had more 1% daily moves. The other years with more 1% days in December all stand out in market history as some of the most volatile years in market history, including 2008 when there were 15 (more than two-thirds of all trading days in the month) 1% daily moves.

There’s still one trading day left in the year, and if the S&P 500 has another 1% day today it will move 2022 into a tie for 5th place with 1974, 1998, 2000, and 2018 in terms of 1% daily moves in December.

Where December 2022 stands out more, however, is in the number of 1% down days. With six 1%+ declines this December, it already ranks as tied for the third most 1% declines during the last month of the year since 1952. The only years with more were 2008 and 2018 while 1973, 1974, 2000, and 2002 are tied with this year. The only thing positive we can say is that it’s almost over, and hopefully, the new year will be ‘happier’.

Our Morning Lineup keeps readers on top of earnings data, economic news, global headlines, and market internals. We’re biased (of course!), but we think it’s the best and most helpful pre-market report in existence!

Start a two-week trial to Bespoke Premium to read today’s full Morning Lineup.